Now you have started making money and you now need to withdraw your funds from Upwork! As a Nigerian, you should know that things aren’t always straightforward; but luckily for us, it is quite easy to get paid on Upwork. In this article, I will explain how to navigate Upwork withdrawals with expert recommendations.

Withdrawals

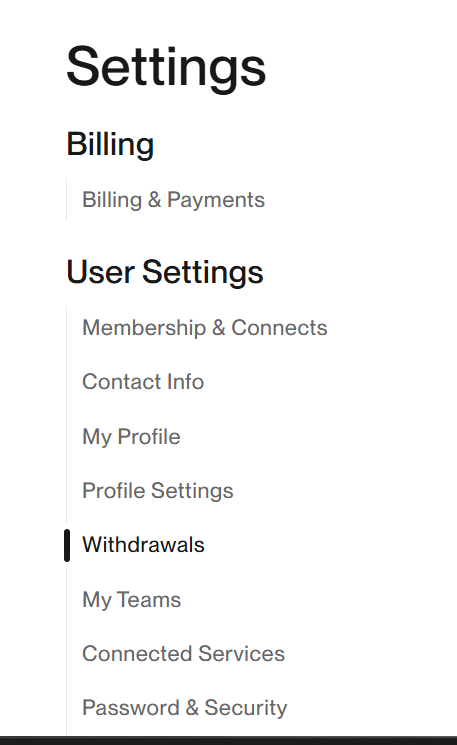

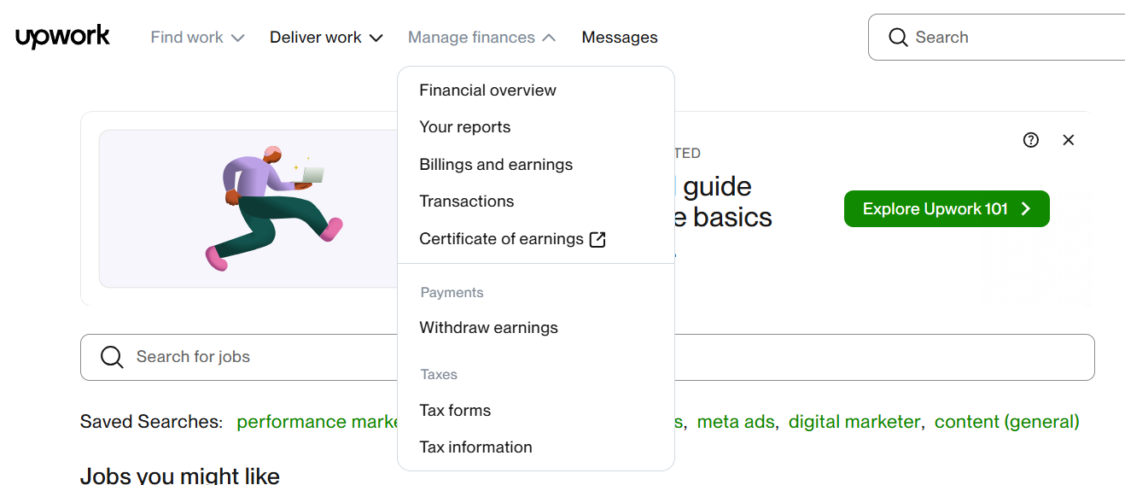

You can access this option via the Account settings page or via your Upwork dashboard as shown below.

Option A: Via the Account settings page

Option B: Via your Upwork dashboard

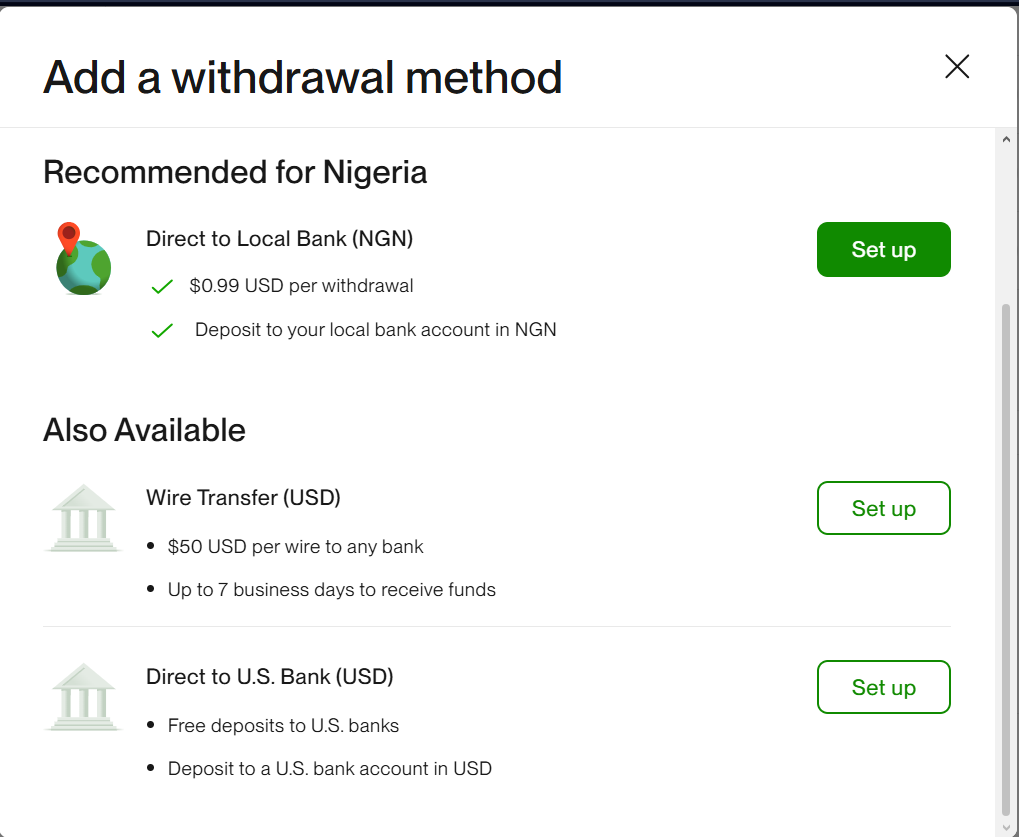

When you then click on add a withdrawal method via the withdraw earnings page, there are 4 options there (including Payoneer).

I use ALL 4! Also, to know the latest USD to Naira exchange rates of various ways I mentioned here, check here

Direct to local bank

This is the fastest and easiest way to get your money, but it is only available in Naira. Before the unification of the exchange rates, Upwork’s naira rate was very low compared to the black market rate; however, it is now kind of comparable now (but still considerably lower), and you could withdraw in Naira without a feeling of despair when you find out the black market rate.

Note: Upwork will charge a fixed fee of $0.99 per withdrawal.

Some of the reasons why you might need to use this option include:

- You want to withdraw less than $50

- You don’t have a dollar account

- You want a very reliable means of payment; others are also reliable.

- You want your small money quickly — the first few payments might take some days, but after that, it is usually super fast.

To set this up, you will need some details which include your bank’s SWIFT code, bank code, etc. SWIFT code is easily available online and Upwork already lists the bank codes of Nigeria here.

However, if you want higher rates for your income and you don’t mind some mild possible delay, then you can use the options below:

Payoneer

When you set up your Payoneer account, you can withdraw from Upwork in USD. Once the USD drops into your Payoneer account, you can then withdraw into either your USD domiciliary account or Naira account. Withdrawing from Payoneer to a USD domiciliary account could take 2-3 business days on average while withdrawing from Payoneer to Naira account can take just a few hours.

Once you have opened your Payoneer account, it is now time to connect it to Upwork. To do that, use the “Set up” option on the Upwork withdrawal page as shown earlier.

The exchange rate from USD to Naira on Payoneer is higher than Upwork’s rate by around 30 Naira (As at when I last checked); however, the least money to withdraw from Payoneer must be equivalent to $50 — so, if you want to withdraw anything lower than that, simply use the Direct to bank (naira) option on Upwork.

If you have a Nigerian dollar account, you can withdraw your money from Payoneer in USD. After withdrawing, you can search for these BDC operators to exchange to Naira.

To withdraw from Payoneer to your USD domiciliary account, you will be charged a transaction fee that changes regularly. Also, note that Upwork will charge a fixed fee of $2 per withdrawal.

Please note

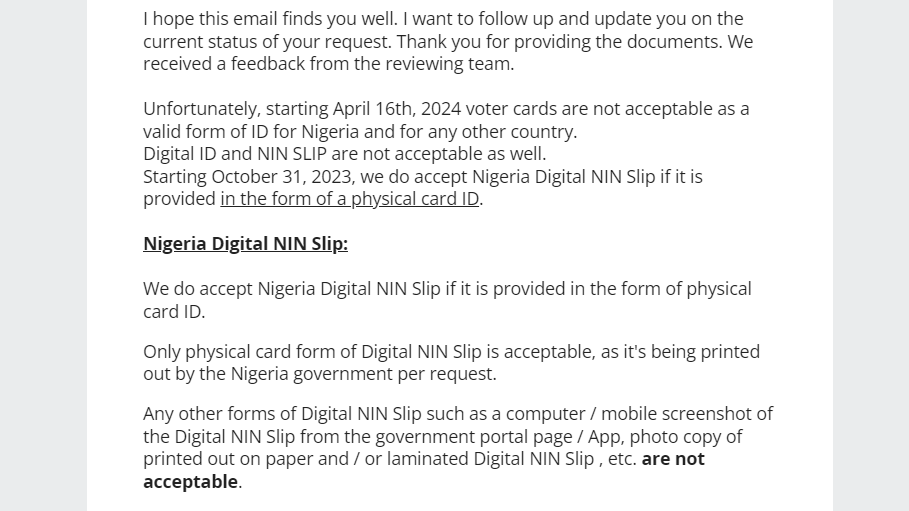

As at when I last checked, Payoneer NOW requires Nigerians to upload a government-verified ID card BEFORE making any transaction. When I contacted them on behalf of a worried freelancer, they clarified the options that they do accept. These include the current national ID card that the FG now gives out; however, it must be printed on plastic — which is something you can do when you go to internet cafe shops. They also accept the original plastic National ID card (for those who have that), driving license, or international passport. Lastly, they don’t accept voter’s card.

Note: In 2023, Access Bank of Nigeria stopped USD transactions with Payoneer (I don’t know of Naira though). Also, it seems that withdrawing over $500 (or less) into your GTBank USD account from Payoneer will lead to an unexplained loss of an extra $10 via their intermediary banks (As at when I last checked).

To open a Nigerian dollar account (also called a domiciliary account), go into different Nigerian banks and speak to the account opening team – they will guide you through.

Note: Upwork withdrawal to Payoneer is instant, but Payoneer to Nigerian banks isn’t instant – it can take some time. Also, USD to Naira withdrawals on Payoneer can easily come within a few hours depending on several factors which include the receiving bank’s speed, frequency of withdrawals, day of withdrawal request, time of withdrawal request, etc

If you want to receive your money into your Nigerian accounts (Both USD and Naira) without hassles, make sure of these three things:

- If you want to make USD withdrawals, it is recommended that you request your payment between Monday and Wednesday. Requesting on Thursday or Friday means the money might be delayed till the following week. The speed of the money dropping into your account also depends on your bank.

- Make sure you don’t request payment when there is a bank holiday in Nigeria or the USA to avoid extra delays.

- If you want to withdraw to your Naira account, try to request your money in the morning to get the best rates and also as fast as possible. This is a hack that I discovered when I found out that Payoneer gives better USD – Naira exchange rates in the morning (before 1:30 pm); the exchange rates later in the day are often much lower!

Disclaimer: These payment platforms regularly update their fees, terms of service, etc., So, always do your due diligence before transacting with them.

Wire Transfer

If you have a Nigerian dollar account, you can also withdraw your money through wire transfer – but the transaction fees are higher than of Payoneer ($50 fixed fee per withdrawal). Also, at first, withdrawing via this route could take a few business days on average; though, when you have withdrawn a few times, it could start coming really fast afterward.

If you want to receive your money via wire transfer (USD) without hassles, make sure of these three things:

- Make sure you request your payment between Monday and Thursday. Requesting on Friday means the money could be delayed till the following week. The speed of the money dropping into your account also depends on your bank.

- Make sure you don’t request payment when there is a bank holiday in Nigeria or the USA to avoid extra delays.

- If you want to stand a chance of getting your money the same day, then make sure you request it as early as possible — I often request it before 7 am.

Direct to US Banks

This can be achieved through third-party virtual dollar card platforms such as Geegpay (Now Raenest), Grey, Cleva, etc who have robust provisions to receive your USD from Upwork into your dollar accounts on their platforms. This can also be an option if you trust their platform enough. However, your discretion is highly advised when using them.

I also use this option regularly — however, please do your due diligence!

Conclusion

Withdrawing from Upwork is a complex process and you have to decide which one to go for depending on your circumstances; however, I have explained various things you need to understand that will help you make informed and efficient decisions when withdrawing your hard-earned money. You can check the latest USD to Naira exchange rates of the various ways I mentioned here